November 05, 2018

In most fixed-price contracts, the contractor is responsible for the risk for fluctuations in its labor, equipment, and material costs between when it estimated the project costs and when it actually completed the work and incurred those costs. However, contractors can incur damages if it had to pay higher costs for its labor, equipment, or material because it performed the work later than it originally planned. This increase is called price or cost escalation.

A classic “escalation” example is when a contractor is forced to pay its tradesmen a higher hourly rate than planned because the owner delayed the performance of its work into a time period covered by a new labor agreement that required the contractor to pay a higher amount for tradesmen’s hourly wages and benefits than planned.

Typically, owners and contractors only think escalation costs can occur when work is performed after the project’s completion date. However, this is not always the case. For example, assume a contractor is constructing a multi-year project and the owner significantly delays the project’s critical path, and the project completion date, during the first year of the project. Let’s assume that, as a result of the owner’s delay in the first year, the project is delayed an entire year such that the work that was planned to occur in year 1 is delayed to year 2, the year 2 work is delayed to year 3, and so on. When this occurs, the contractor may have to pay

October 22, 2018

As discussed in previous “Your Critical Path Blog” postings, contractors are only able to recover their extended field office overhead and extended/unabsorbed home office overhead costs as a result of a critical project delay that extends the project’s duration. However, there are other delay-related costs that are not dependent on the existence of a critical project delay.

A contractor’s idle or standby equipment and labor costs, often incurred during a suspension, are an example of delay-related costs. When an owner suspends a project, or a portion of a project, the contractor can incur idle equipment and labor costs. The contractor’s ability to recover its idle equipment and labor costs is dictated by its construction contract, the magnitude and type of the suspension, and the parties’ actions.

For example, if an owner suspends the entire project for a specific time period, the owner may request that the contractor keep specific equipment on site to enable the contractor to resume work immediately after the suspension order is rescinded. In this situation, the contractor would be entitled to recover not only its extended field and home office costs, but also its idle or standby equipment costs. Additionally, the contractor may also be entitled to recover its idle labor costs, if the owner requested that the contractor maintain onsite tradesmen waiting for direction to restart the work.

However, when an owner suspends only a portion of a project, which does not result in a delay to the project’s critical path or the project’s

October 08, 2018

Using the Eichleay, Canadian, Hudson, Manshul, and Specified-Rate Formulas to calculated extended or unabsorbed home office overhead cost can be problematic when applied to a manufacturer or fabricator. Though the issue is still underabsorption, the effect of the delay may be more difficult to evaluate.

To understand this problem, consider the following steel fabricator situation. The steel fabrication plant represents a significant capital investment with monthly operating costs that must be recovered through the fabrication and delivery of structural steel to many construction projects. Fabricators usually “schedule” fabrication in their facilities, with each project being assigned a “window” of time during which fabrication is planned to occur. If the approval of the steel shop drawings is delayed for a particular project because of a design change that is the owner’s responsibility, the fabricator may miss the opportunity to fabricate the project’s steel when it originally anticipated. This may result in the fabricator rescheduling the fabrication of all the work in its facility. In the best-case scenario, this rescheduling is simple—the project that is not ready for fabrication is moved to later in the year and another project is moved up to fill the “hole” left by the delayed project. In the end, the fabrication facility is fully utilized with no downtime, and the costs of owning and operating the facility are covered by the amounts earned for steel fabricated during the year.

However, it’s also possible that moving the delayed project’s steel fabrication to a later period will leave the fabrication facility

September 24, 2018

This posting introduces the Specified-Rate Formula for calculating a contractor’s unabsorbed home office overhead costs after experiencing an excusable, compensable delay. Unlike the Eichleay, Canadian, Hudson, and Manshul Formulas that either must be performed, or are usually performed, after the project is complete, some owners include a home office overhead Specified-Rate Formula in their construction contracts to compensate contractors for their unabsorbed home office overhead costs for compensable delays.

For example, the Ohio Department of Transportation (ODOT) 2016 Construction and Material Specifications includes a Specified-Rate Formula to compensate contractors for “home office overhead, unabsorbed home office overhead, extended home office overhead, and all other overhead costs” for excusable, compensable delays of 10 calendar days or more. Interestingly, ODOT does not compensate a contractor for its home office overhead costs for all excusable delays. In fact, it limits a contractor’s recovery of its home office overhead costs to the following instances:

Delays due to utility or railroad interference within the Project limits.

Delays due to an Engineer-ordered suspension.

Delays due to the neglect of the Department or its failure to act in a timely manner.

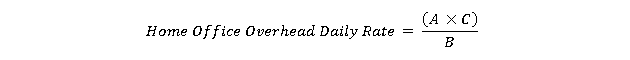

Aside from a delay caused by a third-party interference within the project limits, ODOT treats the contractor’s recovery of home office overhead costs as “unabsorbed” home office overhead costs. ODOT’s formula for calculating a contractor’s daily home office overhead rate is as follows:

Where:

A = original contract amount

B = original contract duration in calendar

September 10, 2018

The Manshul Formula was established by New York State Courts in 1981. The case involved a construction project for the Dormitory Authority of the State of New York (DASNY) for La Guardia Community College, a division of the City University of New York, and the contractor was the Manshul Construction Corporation.

Different from the Eichleay, Canadian, and Hudson Formulas, the Manshul Formula relied on the overhead percentage specified in the construction contract and calculated the contractor’s home office overhead costs for the delay period in a different manner than calculating a daily home office overhead rate.

Unlike the Canadian and Hudson Formulas that multiply the overhead markup percentage by the original contract amount, in Manshul Construction Corp. v. DASNY, the court calculated the contractor’s home office overhead damage amount by totaling the contractor’s project revenue during the project’s extended duration, which equaled $895,785. Then, the court calculated the portion of the revenue earned in the extended period that represented the contractor’s overhead.

The court did this by first noting that the contract included a 15% markup amount for change orders and extra work that covered “cost of supervision, overhead, bond, profit, and any other general expenses,” which was used in the calculation. The court in the Manshul case also recognized that the $895,785 of revenue earned in the extended period included both overhead and profit, not just the contractor’s direct costs (labor, equipment, and material). Said another way, the contractor’s overhead costs were already in the $895,785 amount, so if the court were

August 27, 2018

This posting introduces the Canadian and Hudson Formulas and discusses how they are used to calculate a contractor’s home office overhead costs for a project that experienced an excusable and compensable delay.

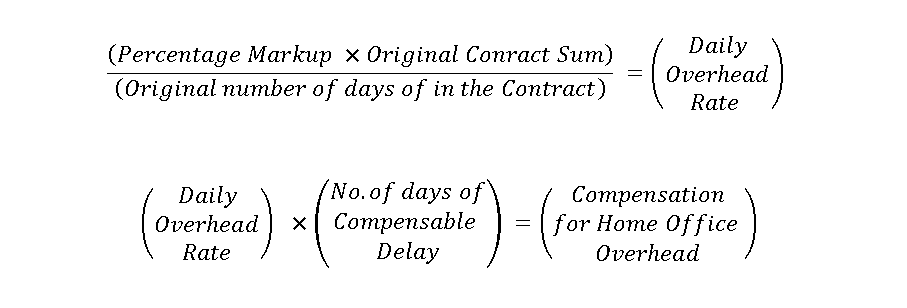

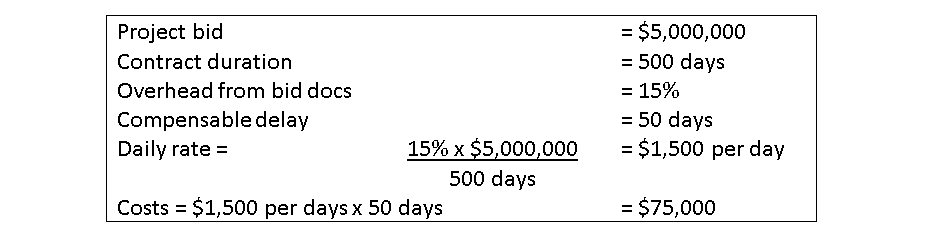

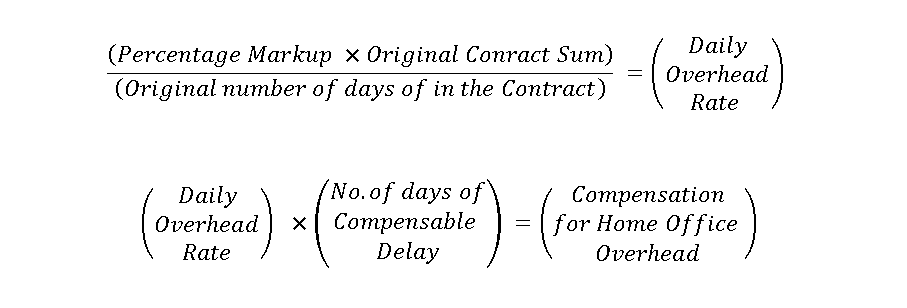

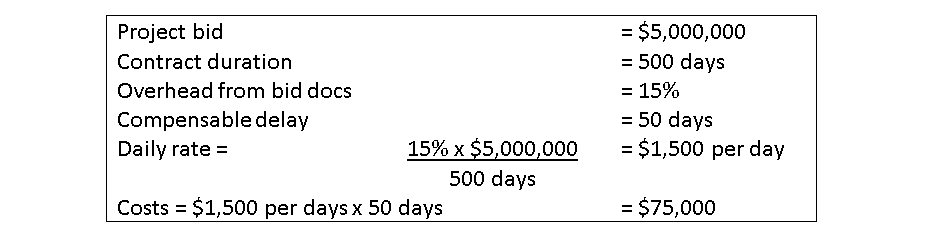

Like the Eichleay Formula, the Canadian and Hudson Formulas calculate a contractor’s home office overhead damage amounts by calculating the project’s home office overhead daily rate and multiplying that rate by the compensable days of delay to calculate contractor’s home office overhead damage amount.

However, unlike the Eichleay Formula, which calculates the subject project’s share of the company’s home office overhead costs based on a percentage of revenue, the Canadian Formula relies on the contractor’s actual overhead markup percentage. The markup percentage can be either the contractor’s planned home office overhead markup percentage supported by its bid documents or its actual home office overhead percentage calculated by an audit of the contractor’s records. The formula is depicted below.

An example using the Canadian Formula to estimate a contractor’s home office overhead compensation for a 50-day compensable delay is below.

The Hudson Formula is nearly identical to the Canadian Formula. However, while the markup percentage used in the Canadian Formula only compensates the contractor for its overhead costs, the Hudson Formula’s markup percentage includes both overhead and profit.

For more on this or any other topic, please call me at 215-814-6400 or email me at mark.nagata@traunerconsulting.com.

August 13, 2018

In the previous posting, I identified five home office overhead formulas (Eichleay, Canadian, Hudson, Manshul, and the Specified-Rate Formulas) that are used to determine a contractor’s home office overhead damage amount.

Each of these five formulas determine the contractor’s home office overhead percentage in different ways and for different reasons, which, in turn, can result in significantly different damage amounts. This and the next couple of postings will describe each of the formulas, their differences, and why they calculate different damage amounts.

The most commonly-known home office overhead calculation method is the Eichleay Formula. The use of the Eichleay Formula was established by an Armed Services Board of Contract Appeals decision in 1960. The project involved the construction of a Nike missile site and the contractor was the Eichleay Corporation. The formula that was used by the board to calculate the Eichleay Corporation’s unabsorbed home office overhead cost has become known as the Eichleay Formula.

In federal contracting and in many state courts and other jurisdictions, the Eichleay Formula is a well-established method to calculate a contractor’s unabsorbed home office overhead amount. However, refinements governing its use seem to accompany each new ruling.

When applying the Eichleay Formula, some courts and triers of fact require that a distinction be made between (1) unabsorbed overhead versus extended overhead and (2) delays caused by additional work versus delays caused by suspensions. Additionally, when using the Eichleay Formula to calculate a contractor’s unabsorbed home office overhead costs, some courts have generally required that the contractor must establish

July 30, 2018

Unabsorbed home office overhead is a well-known, but not well-understood delay damage and, like extended field office overhead, is only recoverable by a contractor after experiencing an excusable, compensable delay. Home office overhead costs include, but are not limited to:

- Home office rental or home office ownership costs,

- Insurance costs that can’t be assigned to a specific project,

- Home office utilities and telephone,

- Home office equipment and maintenance, and

- Salaries of home office staff (company officers, estimators, payroll clerks, receptionists, and others not assigned to a specific project).

Home office overhead costs are indirect costs that a contractor incurs, which are necessary to support all of the contractor’s projects, but are not directly chargeable to any particular project. Typically, the contractor’s home office overhead costs are apportioned or distributed among all of its projects.

Rather than using the term unabsorbed home office overhead, some use the term “extended” home office overhead. More often than not, while there is a distinction between these terms, the two are often used interchangeably. Resolving this issue is beyond the scope of this article, but for the purposes of this article we will use the term unabsorbed home office overhead.

This term is used because payment for home office overhead is typically based on an “underabsorption” argument, not an “extension” argument. For example, consider the cost of the contractor’s Chief Financial Officer. The cost of the CFO is not “extended” if one of the contractor’s projects

July 16, 2018

Perhaps the most common delay-related cost alleged in claims, and as part of time extension requests, is one that focuses on extended field office overhead and job supervision costs. As we know, construction projects require field office labor and equipment to be maintained throughout the duration of the project, but those costs are not necessarily chargeable to a particular item of work. These costs are what we call “time-dependent” costs, and include things such as job site trailers, sanitary facilities, office equipment, security resources, phone/electrical/water services, and salaried job supervision personnel such as project managers, project engineers, superintendents, and administrative staff.

Naturally, when a project is delayed, these time-dependent costs will be required to support the project for a longer time period, and will cost a contractor more than what was anticipated in its bid. The question is – what is the proper way to calculate and account for these increased costs?

Often, both owners and contractors will take the simplest, albeit the least persuasive, way to calculate their field office overhead costs by establishing one field office overhead daily rate for the life of the project. This often results in an amount that is either more or less than the proper amount that should apply for the period in which the delay was experienced.

A contractor’s daily rate for field office labor and equipment is generally not linear over the life of the project. Rather, these costs typically follow a curve as they build up during the initial phases of the project,

July 02, 2018

Field office overhead is perhaps the most well-known and well-understood type of delay damage. A contractor only incurs extended field office overhead costs when the project is critically delayed and when the project’s duration is extended.

Field office overhead costs consist of indirect costs that are incurred and necessary to support the project work at the field level and that are directly chargeable to the project. Field overhead costs include, but are not limited to:

- Field office rental

- Salaries of field office staff

- Field office staff vehicles

- Field office utilities and telephone

- Field office consumables

Extended field office overhead costs (also called jobsite overhead costs) are, by definition, costs that increase due to a critical delay. For example, if the project is delayed a month, then the contractor would incur additional time-dependent field office overhead costs such as the rental cost of the field office, the salaries of field office staff, and similar time-dependent costs incurred to support the contractor’s operations in the field for the project’s additional month of duration.

The contractor’s entitlement to payment for extended field office overhead costs is based upon the presumption that its original contract price only included field office overhead costs needed to support the project during the original project duration. So, when the project duration is extended, the contractor would incur additional field overhead costs to support the project. If the extended project duration was caused by an excusable and