Delay Damages: Contractor HOOH Formulas 3 Of 4 (Manshul Formula)

The Manshul Formula was established by New York State Courts in 1981. The case involved a construction project for the Dormitory Authority of the State of New York (DASNY) for La Guardia Community College, a division of the City University of New York, and the contractor was the Manshul Construction Corporation.

Different from the Eichleay, Canadian, and Hudson Formulas, the Manshul Formula relied on the overhead percentage specified in the construction contract and calculated the contractor’s home office overhead costs for the delay period in a different manner than calculating a daily home office overhead rate.

Unlike the Canadian and Hudson Formulas that multiply the overhead markup percentage by the original contract amount, in Manshul Construction Corp. v. DASNY, the court calculated the contractor’s home office overhead damage amount by totaling the contractor’s project revenue during the project’s extended duration, which equaled $895,785. Then, the court calculated the portion of the revenue earned in the extended period that represented the contractor’s overhead.

The court did this by first noting that the contract included a 15% markup amount for change orders and extra work that covered “cost of supervision, overhead, bond, profit, and any other general expenses,” which was used in the calculation. The court in the Manshul case also recognized that the $895,785 of revenue earned in the extended period included both overhead and profit, not just the contractor’s direct costs (labor, equipment, and material). Said another way, the contractor’s overhead costs were already in the $895,785 amount, so if the court were to markup the $895,785 earned-revenue amount by 15%, it would have marked up the already marked-up contract payment.

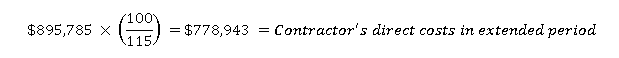

As a result, the court used the following equation to calculate the contractor’s direct cost component of the $895,785 revenue amount in the extended period

Given the 15% markup was identified in the contract as inclusion of overhead and profit, the court stated that the contractor was not entitled to receive duplicate profit and split the 15% equally between overhead (7.25%) and profit (7.25%).

The court then calculated an additional overhead amount of $56,473 by multiplying the contractor’s calculated direct costs in the extended period by the 7.25% markup percentage for overhead ($778,943 x 7.25% = $56,473).

Although the court stated that the contractor was not entitled to a “duplicative profit based on the direct cost of the work during the delay period or on the profit portion of the contract price,” it did state that the contractor was entitled to recover the profit on the additional overhead amount totaling $4,094 ($56,473 x 7.25% = $4,094). Therefore, it calculated the additional overhead and profit total as $60,567 ($56,473 + $4,094 = $60,567). Additionally, the court also recognized that it had to account for the fact that the project was delayed by both parties. After acknowledging that the contractor was responsible for 5% of the extended project duration, it multiplied the additional overhead and profit total by 95%, resulting in total damage amount of $57,539 ($60,567 x 95% = $57,539).

In summary, the Manshul Formula relies on the revenue earned during the extended project duration to calculate the direct cost of the work completed in the extended period, calculates the overhead portion of the revenue earned in the extended period, calculates additional profit on the calculated overhead, and, then, compensates the contractor for the additional overhead and profit based amount of the project delay that is the owner’s responsibility.

For more on this or any other topic, please call me at 215-814-6400 or email me at mark.nagata@traunerconsulting.com.