Delay Damages: Fabricator/Manufacturer HOOH Formula (Allegheny & Carteret Formulas)

Using the Eichleay, Canadian, Hudson, Manshul, and Specified-Rate Formulas to calculated extended or unabsorbed home office overhead cost can be problematic when applied to a manufacturer or fabricator. Though the issue is still underabsorption, the effect of the delay may be more difficult to evaluate.

To understand this problem, consider the following steel fabricator situation. The steel fabrication plant represents a significant capital investment with monthly operating costs that must be recovered through the fabrication and delivery of structural steel to many construction projects. Fabricators usually “schedule” fabrication in their facilities, with each project being assigned a “window” of time during which fabrication is planned to occur. If the approval of the steel shop drawings is delayed for a particular project because of a design change that is the owner’s responsibility, the fabricator may miss the opportunity to fabricate the project’s steel when it originally anticipated. This may result in the fabricator rescheduling the fabrication of all the work in its facility. In the best-case scenario, this rescheduling is simple—the project that is not ready for fabrication is moved to later in the year and another project is moved up to fill the “hole” left by the delayed project. In the end, the fabrication facility is fully utilized with no downtime, and the costs of owning and operating the facility are covered by the amounts earned for steel fabricated during the year.

However, it’s also possible that moving the delayed project’s steel fabrication to a later period will leave the fabrication facility underutilized during the project’s planned fabrication window. The Eichleay Formula is not designed to calculate the resulting underabsorption. It is more applicable to the evaluation of the unabsorbed home office overhead costs of a construction project. Also, the issue is not so much one of delay but one of underabsorption. The problem for the fabricator is not that the fabrication window slipped a month, the problem is that its fabrication facility and workers were idle or operating at reduced capacity during the originally scheduled window.

For manufacturers and fabricators, the more appropriate formula to use for this set of facts is the Allegheny Formula. That’s because the Allegheny Formula is based on a comparison of the contractor’s actual overhead rates between the originally expected performance period and the actual period of performance, not on the duration of the delay.

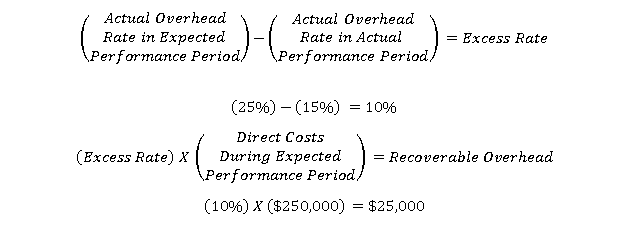

As an example, assume a steel fabricator planned to fabricate the steel for our project in June, but due to an owner delay the steel was fabricated in September, three months later. During the month of June, the fabricator’s actual overhead absorption rate was 25%. This means that, during the month of June, the fabricator’s actual overhead costs divided by its actual labor and materials costs were 25%. During the month of September, when the steel for our project was actually fabricated, the fabricator’s actual absorption rate was 15%. This means that the fabricator’s overhead costs were absorbed by, or spread over, its normal volume of work, not the reduced volume in June. In both months, the contractor’s monthly home office overhead costs were the same, but the revenue earned in September was much higher than the revenue earned in June. The difference between the two months was 10%. This percentage is then multiplied by the cost of the delayed steel work. If the labor and materials costs for the delayed steel were $250,000, then the resulting unabsorbed home office overhead amount is $25,000, as follows:

Allegheny Formula

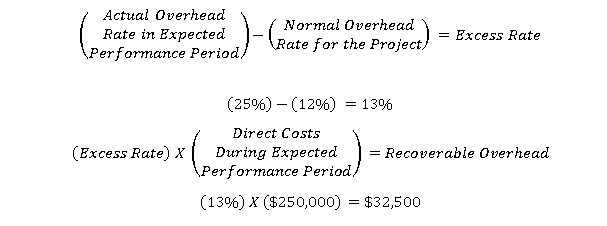

Therefore, unlike the other formulas, the Allegheny Formula compares the absorption rates in two corresponding periods to calculate the difference, which is then multiplied by the direct costs of the work to calculate the fabricator or supplier’s underabsorbed home office overhead damage amount. The Carteret Formula is similar to the Allegheny Formula in that overhead rates are compared to calculate the percentage of underabsorption in the originally expected performance period. However, instead of using the contractor’s actual overhead rate when the work was completed as the basis of measurement, the contractor’s normal overhead rate is used for the project. To demonstrate, let’s use the same project example discussed above, but let’s assume that the contractor’s normal overhead rate is 12%. The formula would then calculate the following unabsorbed home office overhead amount.

Carteret Formula

For more on this or any other topic, please call me at 215-814-6400 or email me at mark.nagata@traunerconsulting.com