Delay Damages: Do You Have Unabsorbed Home Office Overhead Cost?

Unabsorbed home office overhead is a well-known, but not well-understood delay damage and, like extended field office overhead, is only recoverable by a contractor after experiencing an excusable, compensable delay. Home office overhead costs include, but are not limited to:

- Home office rental or home office ownership costs,

- Insurance costs that can’t be assigned to a specific project,

- Home office utilities and telephone,

- Home office equipment and maintenance, and

- Salaries of home office staff (company officers, estimators, payroll clerks, receptionists, and others not assigned to a specific project).

Home office overhead costs are indirect costs that a contractor incurs, which are necessary to support all of the contractor’s projects, but are not directly chargeable to any particular project. Typically, the contractor’s home office overhead costs are apportioned or distributed among all of its projects.

Rather than using the term unabsorbed home office overhead, some use the term “extended” home office overhead. More often than not, while there is a distinction between these terms, the two are often used interchangeably. Resolving this issue is beyond the scope of this article, but for the purposes of this article we will use the term unabsorbed home office overhead.

This term is used because payment for home office overhead is typically based on an “underabsorption” argument, not an “extension” argument. For example, consider the cost of the contractor’s Chief Financial Officer. The cost of the CFO is not “extended” if one of the contractor’s projects is delayed. The CFO’s salary does not change and the CFO is not paid for a longer time period like the salary of the project superintendent in the event of a delay.

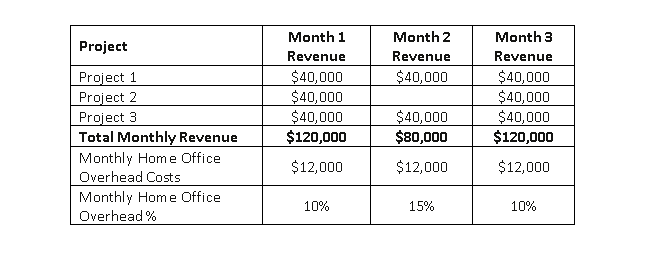

The classic “underabsorption” example is a suspended project. As an example, let’s assume a contractor is working on three projects, each earning the same revenue as depicted in the table below.

In Month 2, Project 2 was suspended the entire month and, as a result, the contractor earned no revenue from that project. As such, in Month 2, the contractor’s total revenue was decreased by $40,000. However, its home office overhead costs stayed constant. So, in Month 2, Projects 1 and 3 each had to absorb $6,000 of the contractor’s home office overhead costs, as opposed to the anticipated $4,000, to compensate for the lack of revenue from Project 2 during that month. Thus, Projects 1 and 3 had to “absorb” more than their planned share of the contractor’s Month 2 home office overhead costs. A contractor might argue that this was unfair, and that the owner of Project 2 should reimburse the contractor $4,000 for the lack of Project 2 revenue absorbing its share of the contractor’s home office overhead costs in Month 2. While there is no precedent for reimbursing a contractor for home office overhead costs in full, such as the $4,000 as described in this example, there is, however, ample precedent for paying the contractor some amount, particularly on federal government projects and in other circumstances where the contract or the law does not ban payment.

In Month 2, Project 2 was suspended the entire month and, as a result, the contractor earned no revenue from that project. As such, in Month 2, the contractor’s total revenue was decreased by $40,000. However, its home office overhead costs stayed constant. So, in Month 2, Projects 1 and 3 each had to absorb $6,000 of the contractor’s home office overhead costs, as opposed to the anticipated $4,000, to compensate for the lack of revenue from Project 2 during that month. Thus, Projects 1 and 3 had to “absorb” more than their planned share of the contractor’s Month 2 home office overhead costs. A contractor might argue that this was unfair, and that the owner of Project 2 should reimburse the contractor $4,000 for the lack of Project 2 revenue absorbing its share of the contractor’s home office overhead costs in Month 2. While there is no precedent for reimbursing a contractor for home office overhead costs in full, such as the $4,000 as described in this example, there is, however, ample precedent for paying the contractor some amount, particularly on federal government projects and in other circumstances where the contract or the law does not ban payment.

The calculation of the contractor’s unabsorbed home office overhead costs is usually determined through the use of appropriate apportionment formulas. These formulas can be organized into the following two categories:

Contractor Home Office Overhead Formulas:

- Eichleay

- Canadian

- Hudson

- Manshul

- Specified-Rate

Fabricator/Manufacturer Home Office Overhead Formula:

- Allegheny

- Carteret

Also, note that the primary condition for recovery of unabsorbed home office overhead is that the project must have experienced an excusable, compensable delay. Similar to extended field overhead costs, the executed change orders need to be evaluated, because if the change order work caused critical project delay, then the change order may address the contractor’s recovery of unabsorbed home office overhead costs. However, applicable contractual, statutory, or legal requirements will ultimately determine the contractor’s ability to recover its unabsorbed home office overhead costs.

Please look for more detailed discussions of these formulas and how they are used to calculate unabsorbed home office overhead costs in future postings.

For more on this or any other topic, please call me at 215-814-6400 or email me at mark.nagata@traunerconsulting.com.